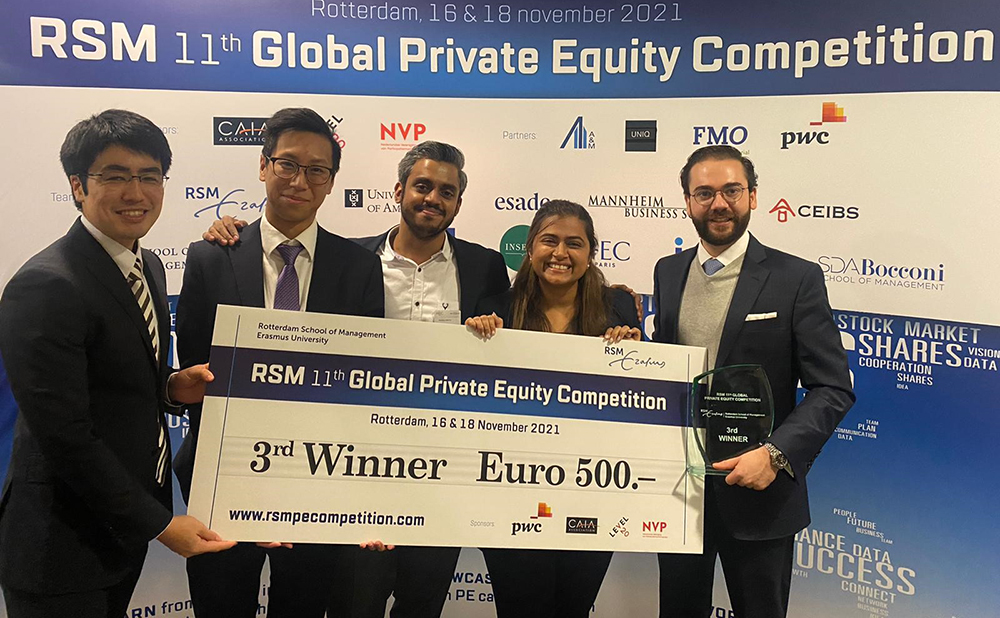

Five HEC Paris MBA students won big in the RSM 11th Global Private Equity Competition, a world-renowned case contest featuring teams from the best business schools in the world.

At the flagship PE/VC competition organized by the Rotterdam School of Management, students Mathangi Chandrasekhar, Adolfo Ruiz, Atsushi Mitani, Anubhav Shetty and Seng Long (Kelvin) Lai faced off against 17 teams from 12 top universities. With their detailed analysis of the risks and returns involved with investing in an AgriTech company specialized in plant phenotyping, they sailed to a third-place finish.

“The first challenge was even finding the time to devote to the competition, given all the activities that we had going on,” Adolfo said. “We had nine days to analyze a case and present it to the simulated investment committee.”

Since all five students had started the HEC Paris MBA in September 2021, the team was juggling a full course schedule while preparing for the November 16 competition. They were also in the middle of their campaign to head the MBA’s Private Equity/Venture Capital Club—which they won.

Although the MBAs had a combined 29 years’ experience in the PE/VC space, this was the first time any of them had encountered the niche industry of plant phenotyping.

“We used the same playbook that we would in the real world,” Anubhav explained. “We reached out to people who are experts in the sector, and asked them to explain—just like you’d explain it to an 8-year-old—how crop phenotyping works. That worked wonders for us in the Q & A sessions, when the judges were really grilling us. We could talk to them at a fundamental level and show that we really understood the space.”

“Even before we landed at HEC, we were already discussing our goals. It’s a bunch of very pumped people.” —Adolfo Ruiz, MBA ’23

Being part of the HEC Paris MBA’s most recent cohort meant that the team hadn’t yet taken any PE/VC courses. But a PE/VC Club workshop did introduce them to Jean-François Helfer, MBA ’00, Director of CapField Private Equity and a lecturer at HEC Paris. He voluntarily reviewed their slide deck and pitch.

The team also had outstanding skillsets gained from the real world. “Everybody brought so much to the table,” Mathangi said. “Anubhav and I could use what we’d learned working in India, especially on the structuring part. Adolfo is a modeling expert. Atsushi had worked on funds in Japan and Singapore, and he has a knack for making presentations. Kelvin really understood the technology. So it all came together really well.”

They also learned from each other. “For me, I had never worked in private equity, so I had a ton of learning from Adolfo and Kelvin,” said Mathangi, who had worked with Anubhav on the same venture capital fund in India. “And I had so much to learn from Atsushi. The way he put our Powerpoints together, he works like a magician.”

In fact, the five students wasted no time in challenging themselves to leave their mark on the MBA program. “The communication was on from Day 1,” Adolfo says. “Even before we landed at HEC, we were already discussing our goals and what we want to do with the PE/VC Club and with our careers. It’s a bunch of very pumped people.”

Recent Comments