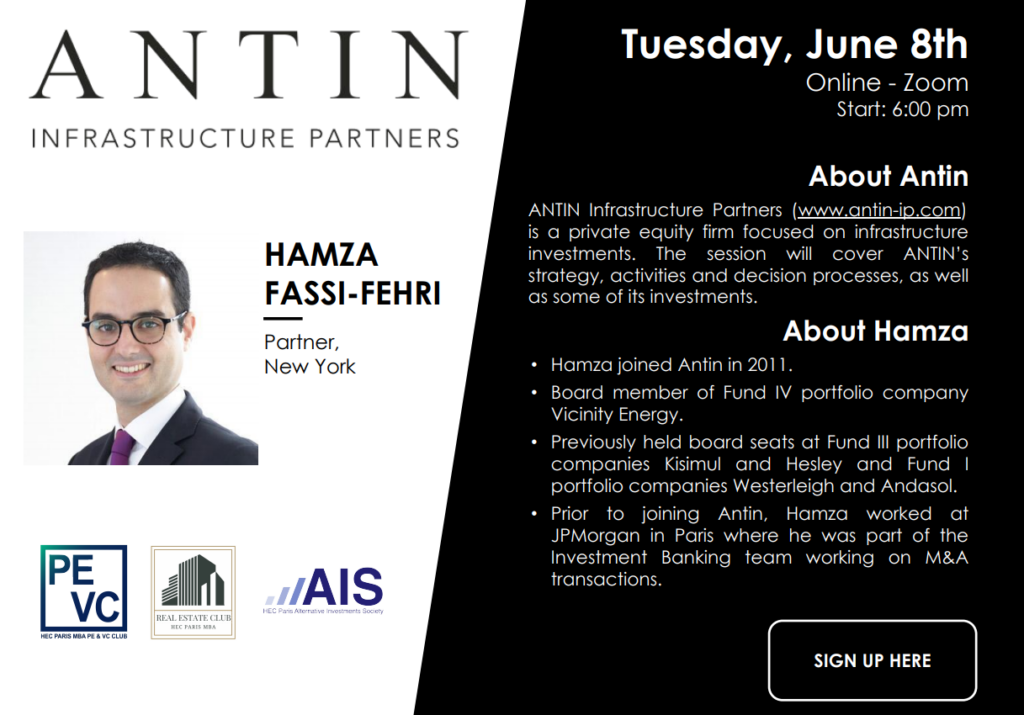

On June 8, the HEC Paris MBA’s Private Equity Club organized a webinar with Antin Infrastructure Partners, the European leader in infrastructure investments. Hamza Fassi-Fehri, a 2008 graduate of HEC Paris and a partner at Antin in New York and Alexandre Keller, a 2015 graduate of HEC Paris and an associate at Antin in Paris, presented their activities. More than 120 students from different programs, including the MBA, Executive MBA, Masters in Finance and more, attended this two-hour session.

Context

In 2018, Antin and HEC Paris created a joint chair dedicated to private equity and infrastructure. This webinar is one of several actions that take place annually between Antin and HEC Paris to ensure that professionals working in private equity have the expertise to manage large-scale and increasingly complex long-term infrastructure projects. Alain Rauscher, Antin’s CEO and one of the two managing partners of the firm, graduated from HEC Paris in 1984. The chair is coordinated by Denis Gromb, an award-winning Professor at HEC Paris.

The HEC Paris MBA’s Private Equity Club organizes this webinar every year following the MBA’s Corporate Finance course. During this course, students put into practice the knowledge they acquired through the “Private Equity and Infrastructure: Antin’s TowerCo Deal” case study. This prize-winning case was written by Professor Gromb.

Summary of the Webinar

Antin Partner Hamza Fassi-Fehri began by sharing an overview of Antin’s activities with us. The firm manages funds that invest in infrastructure in Europe, Canada and the United States. They aim to take control of companies operating mainly in the areas of energy and environment, telecommunications, transport and social infrastructure. Antin takes an active approach to asset management with the goal of generating reasonably risky and, above all, attractive returns for investors through a combination of capital appreciation and dividends. Antin is a responsible investor that improves the financial performance, quality of service, and environmental impact of its business portfolio.

Antin Partner Hamza Fassi-Fehri began by sharing an overview of Antin’s activities with us. The firm manages funds that invest in infrastructure in Europe, Canada and the United States. They aim to take control of companies operating mainly in the areas of energy and environment, telecommunications, transport and social infrastructure. Antin takes an active approach to asset management with the goal of generating reasonably risky and, above all, attractive returns for investors through a combination of capital appreciation and dividends. Antin is a responsible investor that improves the financial performance, quality of service, and environmental impact of its business portfolio.

Entry of Antin into Babilou’s Capital End 2020

For his part, Alexandre Keller presented Antin’s recent investment in Babilou. This company offers collective childcare services in day-care establishments, some operated under the Babilou banner and others operated through partnerships. Antin’s acquisition of a stake in Babilou at the end of 2020 has enabled the group to initiate a new stage in its development. It strengthens its service offering in France and addresses its goal of growing internationally. Throughout the presentation, students asked a series of questions about Antin’s investment strategy.

Importance of Antin’s Management Teams in Antin’s Investments

Responding to a question from Executive MBA student Sylvain Mestrallet, EMBA ’21, Alexandre emphasized the fundamental role of the management team of the companies Antin invests in: “By having an approach focused on the added value of the investment, Antin works closely with the management teams to enable the growth of the companies. We look for management teams that have demonstrated excellence in business management and we consider it important to have the same objectives over the long term.”

The HEC Paris MBA Private Equity Club would like to say a big “Thanks!” to Hamza and Alexandre for the insightful presentation on Antin, and especially for their heroic efforts to answer all the students’ questions. We would also like to thank Professor Gromb for organizing this discussion. Your various Corporate Finance courses gave us the precious knowledge to understand the concepts discussed during this event.

Recent Comments